AJB is one of the important documents that you need to check for authenticity when buying and selling property (land, buildings, etc.)

Evidence of this one sale and purchase transaction is as important as IMB Certificates, Certificates of Ownership (SHM), Land and Building Tax Letters, and other important documents of ownership.

Without an AJB, it will be difficult for you to take care of returning the name of the land title. Therefore, let's understand further what is meant by AJB along with other important points here.

1. What is AJB?

Deed of sale and purchase or abbreviated as AJB is legal evidence of the transfer of rights to a property due to a sale and purchase process. In it there is an agreement between two parties, namely the buyer and the seller.

Even so, AJB cannot be said to be an official document of property ownership like SHM. This is because this document was issued by the Land Deed Making Officer (PPAT) and not the National Land Agency (BPN).

However, technically AJB cannot be made haphazardly. You must come directly to the PPAT office based on the knowledge of both parties, namely the seller and the buyer.

In short, AJB is one of the legal requirements for buying and selling property which contains a statement if the land or building being sold is transferred from the seller to the buyer.

2. The function of AJB

AJB is an important document that has various crucial functions. Including the following.

2.1. Valid Proof of Buying and Selling Transactions

The deed of sale and purchase is valid proof of the legal transfer of property ownership rights. This can happen because AJB is not made haphazardly

2.2. Legal Protection

AJB is legal proof of sale and purchase that you can use as evidence in the event of a dispute or dispute between the seller and the buyer.

2.3. Requirements for Submitting Financing

In several financial institutions such as banks, AJB is often used as one of the loan conditions along with SHM/SHGB certificates and other supporting documents in accordance with applicable requirements. Even so, you need to know that at BFI Finance AJB is not one of the requirements for applying for a house certificate guarantee loan.

3. Contents of the AJB Letter

Reporting from brighton.co.id, AJB is a sale and purchase deed which contains the following important components.

1. Time and date of submission

2. Full identity of the seller and the buyer

3. Complete data regarding the property being traded, such as land area, price, and location

4. Letterhead from PPAT or notary

5. Several agreements have been agreed upon by both parties

6. Signature stamped by both parties

4. Requirements for Making AJB

After you know what a deed of sale and purchase is and the important components in it. The requirements for making AJB are conditions that must be met by each party in a sale and purchase transaction.

4.1 AJB Making Requirements Document for Sellers

The following are the documents you need to complete to make an AJB from the seller's side.

1. Photocopy of e-KTP

2. Photocopy of Spouse's e-KTP (For Married)

3. Photocopy of KK (Family Card)

4. Photocopy of Marriage Certificate (For Family Owners)

5. Original Land Certificate and Authenticity Proven at BPN

6. Proof of Payment of Land and Building Taxes for the Last 5 Years and STTS (Deposit Receipt)

7. Original building permit (IMB) (if there is already a building on the land)

8. Roya Letter (if the property has previously been used as collateral to a bank or financing company)

9. Statement if the property/land/is not being used as collateral

10. Letter of Approval from the Legal Owner/Heir/Spouse

4.2 AJB Making Requirements Document for Buyers

The following are the required documents that you need to fulfill for making AJB from the buyer's side.

1. Photocopy of e-KTP

2. Photocopy of Spouse's e-KTP (For Married)

3. Photocopy of KK (Family Card)

4. Photocopy of Marriage Certificate (For Family Owners)

5. Photocopy of NPWP (Taxpayer Identification Number)

6. Indonesian citizen certificate

7. Proof of Income Tax Payment of 5% of the Transaction Value (Optional)

4.3 Cost of Making AJB

The cost of making AJB is a fee that is determined based on the selling price agreement. Meanwhile, the amount has been regulated in Ministerial Regulation ATR/Head of BPN No. 33 of 2021 concerning Fees for Officials Making Land Deeds. Where in Article 1 it is stated that the cost of making a Sale and Purchase Deed (AJB) may not exceed 1% of the transaction value and the existing costs include fees for witnesses to make a deed.

In addition, AJB fees are also adjusted to the existing transaction value, in more detail as follows.

-

≥ IDR 500,000,000 (five hundred million) = Maximum 1% X Transaction Value

IDR 500,000,000 (five hundred million) - IDR 1,000,000,000 (one billion) = Maximum 0.75% X Transaction Value

> IDR 1,000,000,000 (one billion) – IDR 2,500,000,000 (two and a half billion) = Maximum 0.5% X Transaction Value

> IDR 2,500,000,000 = Maximum 0.25% X Transaction Value

Sample case

For example, if you buy a piece of land at a price of IDR 2,250,000,000, then the maximum fee for making AJB by PPAT is as follows.

IDR 2,250,000,000 X 0.5% = IDR 11,250,000

Apart from the cost of making AJB through PPAT, you also need to pay other costs such as:

- PPh 5% X Transaction Value

- Land and Building Rights Acquisition Fee (BPHTB) 5% X (NJOP – NJOPTKP)

- BPHTB Validation Fee

- PPh Validation Fee

- Non-Tax State Revenue (PNBP) behind the name

- PNBP Mortgage Right

Therefore, make sure you prepare an adequate budget to take care of the cost of making AJB, OK, Sobat BFI!

5. The Difference Between AJB Letters and SHM and PPJB

Inland or property buying and selling transactions, generally we will be familiar with new terms other than AJB, for example, SHM and PPJB. So, what are the differences between the existing terms? Here's the description.

PPJB or Sale and Purchase Binding Agreement is a deed drawn up by a prospective seller or buyer without involving a notary. Legally, a PPJB that is deliberately made as an initial agreement in a sale and purchase transaction cannot be said to be valid or valid evidence because it does not involve an appointed party such as a notary or PPAT.

Even so, PPJB was made one of the conditions for administering AJB to the local PPT office. After the AJB is completed, then you can only take care of returning the name of the house certificate to get a Certificate of Ownership (SHM) in your name.

Next, let's discuss what SHM is. SHM stands for Certificate of Ownership of property, such as land, buildings, and so on. This certificate is proof of legal ownership, legally recognized, and holding the highest position. Therefore SHM can be used as collateral to apply for loans to banks or finance companies.

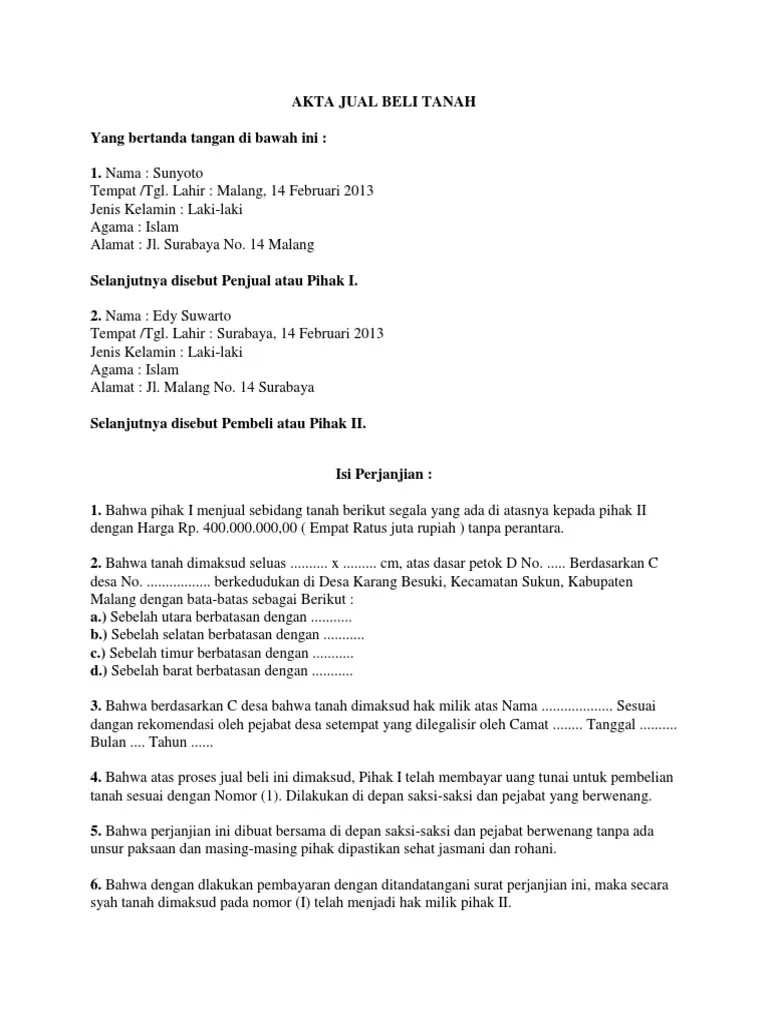

6. Example of Deed of Sale and Purchase

Ilustrasi Contoh AJB | Image Source: scribd.com/habibie82

7. Beware of Illegal AJB, Here are Some Tips You Need to Know!

Property such as land, buildings, and so on are valuable assets of high value. No doubt, this large value is widely used by bad people to make a profit by falsifying AJB.

For this reason, you should know how to distinguish genuine and illegal AJB so that you are not easily fooled by irresponsible people. Here are some tips you can do:

7.1. Check Document Authenticity

Make sure the AJB is from a registered notary or PPAT. The method is that you can verify it by contacting the notary office or PPAT whose name is recorded in the AJB document.

7.2. Check Existing Signatures

Second, make sure the signature on AJB is a fake signature and not an engineering one. To distinguish between an original signature and a fake or imitation, you can compare it with other documents such as identity cards or other official documents.

7.3. Look at the Document Carefully

Illegal documents are generally quite easy to compare with the original. Some of the characteristics are that the form of the signature is different from the original owner and generally does not appear, the stamp or stamp used tends to be different from that issued by the authorities, and sometimes we can find cracks, tears, or even asymmetrical documents. If there is one of these things, you should be aware of the AJB.

7.4. Make AJB in accordance with the existing agreement

Finally, ensure that the procedure for making AJB is in accordance with the agreement between the two parties, where all existing processes are transparent and carried out jointly. Starting from going to the PPAT office and signing the document. And what is no less important, make sure that during the signing process, two witnesses are present, such as the RT or RW where the property is located.

BFI friends, that's an explanation regarding AJB Is: Definition, Functions, Methods, and Terms of Making. Make sure to be observant when going to buy and sell transactions, especially properties with a fairly high value. Do not let disputes occur in the future that could harm you and your family.

Need a large loan? Apply for a house certificate guarantee loan at BFI Finance!

The right solution to make all your dreams come true. Get funds disbursement of up to 85% of the guaranteed asset value. You can get complete information regarding loans at the following link.

Get disbursement funds of up to 85% of the vehicle value and a tenor of up to 4 years.

Get a loan with a fast process and a maximum tenure of up to 24 months.

Low interest starting from 0.9% per month and long tenor of up to 7 years.

Get other interesting information only on the BFI Finance Blog!