How to see the motorbike tax at the STNK is an alternative way you can do to find out the amount of motorbike tax. As written in Regional Regulation (PERDA) Number 8 of 2010 concerning Motorized Vehicle Tax, where every person or entity is required to pay tax on vehicle ownership.

So, for those of you who want to check motorbike tax rates via STNK or other alternative methods, you can follow the procedure below.

1. An Easy Way to See Motorbike Taxes at STNK

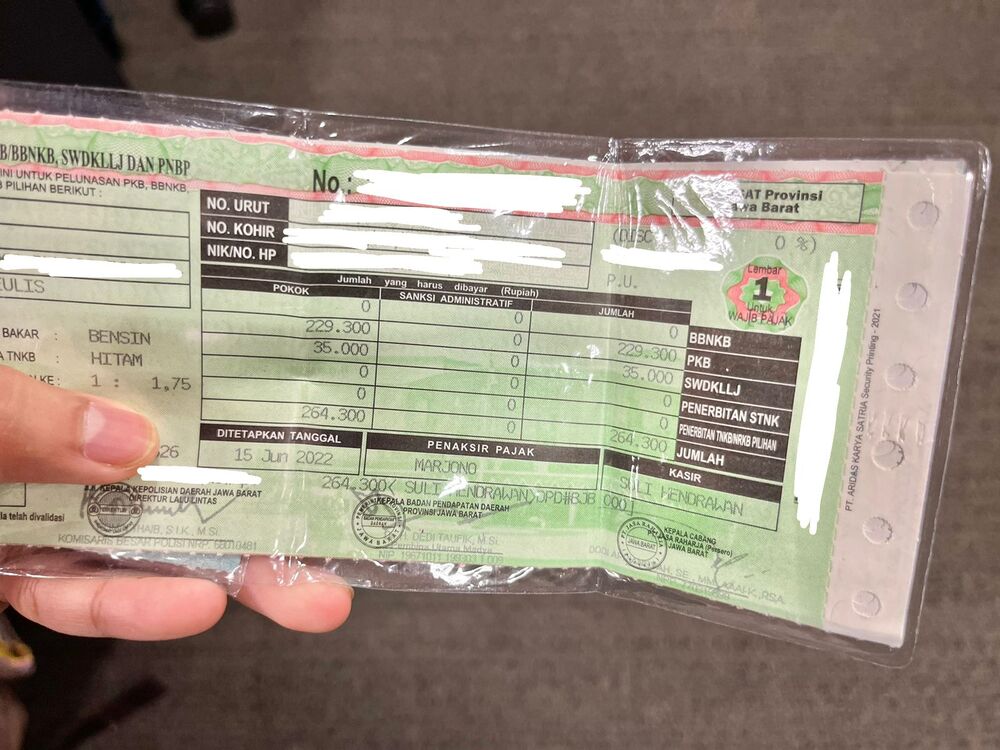

How to see the motorbike tax on the STNK is quite easy. You only need to see one side of the STNK. In that section, there is a table that shows details of the amount of vehicle tax complete with the amount of tax that must be paid along with the date of stipulation. The details are like the picture below.

Image Source: BFI Finance Photo Asset

2. 5 Motor Tax Terms in STNK

To make it easier for you to find out the amount of tax to be paid, it's a good idea to first know the various terms that exist in the STNK.

2.1. BBN KB

BBN KB or an abbreviation of Motorized Vehicle Title Transfer Fee is the amount of tariff charged to owners of motorized vehicles based on the purchase price. For new vehicles, the tariff is set at 10%, while for used vehicles ⅔ of the PKB value.

2.2. PKB

PKB or Motor Vehicle Tax is a vehicle tax calculated from the sales value of the vehicle. The rate is 1.5% and will continue to decrease along with the depreciation of the selling value of the vehicle every year.

2.3. SWDKLLJ

SWDKLLJ stands for Compulsory Road Traffic Accident Fund Contribution. SWDKLLJ rates are determined in accordance with the regulations used for guarantees for all motorized vehicle owners. The existing contribution will later be accommodated by PT. Jasa Raharja in accordance with Law No. 34 of 1964.

2.4. Biaya Adm

Biaya Adm or the usual administration is imposed on new vehicle owners. Generally, this rate comes into effect when you want to change your name or when you want to replace your 5-year motorbike plate.

2.5. Vehicle Tax Fines

Finally, the vehicle tax fine. This fine will apply if you are late paying motorbike or car taxes. With the provision that it is mandatory to pay a fine of PKB and SWDKLLJ.

3. How to See Motorbike Taxes Other Than STNK

Apart from how to view motorbike tax at the STNK, you can also check motorbike tax in other alternative ways, starting from Applications, Call Centers, SMS, and Websites, to Online Taxes. For more details regarding the checking procedure, you can see as follows.

3.1. Police Ranmor Check Application

For those of you who own an Android phone, you can check the motorbike tax through an application made by Info86 Studio called Cek Ranmor DKI Jakarta. You can download this application on the Play Store for free to access information related to motorcycle tax and other details.

3.2. Call Center

Call center services are another option that you can choose to find out about CLA. The method is by dialing *368881# on your cellphone and the call center will tell you in detail the amount of tax that needs to be paid. Don't forget to prepare NOPOL and NIK.

3.3. SMS

Motorbike tax rates can also be checked via SMS in the following way:

- Type info (space) vehicle number (space) vehicle number/number

- Double-check the vehicle number you entered

- Send SMS to 8893

3.4. SAMSAT Official Website

As well as the three ways to see the motorbike tax at the previous STNK, you can also check it on the SAMSAT official website. The site will display the tax rate and the due date of your vehicle. Unfortunately, access to this website is still very limited and can only be accessed in certain areas.

DKI Jakarta

For those of you whose vehicles are registered in the DKI Jakarta area, you can check them via the following link. The steps are as follows.

- Visit the official website of SAMSAT DKI Jakarta.

- Fill in the existing columns, namely the NOPOL (Police Number) and NIK (Resident Identification Number) columns according to the vehicle owner's data.

- Make sure the data entered is correct. Next, verify the reCAPTCHA.

- Click 'Search'.

- Wait a moment until the data you requested is displayed on the screen

Keep in mind, the total fare shown does not include motorbike tax penalties (if any) and vehicle progressive taxes.

West Java

If your vehicle is registered in the West Java area, you can take advantage of the JABAR Samsat site by accessing the following link. The way to check it is as follows.

- Open the West Java Samsat site.

- Fill in the available fields starting with the Motor Vehicle Registration Number (Police Number) and the TNKB Color.

- Next, fill in the requested security code by entering the number in the Captcha section.

- Click 'Search'.

- Wait a few moments until the Jabar Samsat site displays information about your vehicle tax.

Central Java

For those of you who own a motorized vehicle in the Central Java region, you can visit the following website to make the process of checking vehicle tax easier. The steps are:

- Go to the official website of the Central Java Samsat.

- Fill in the fields provided, and enter the police number and license plate of your vehicle.

- Select 'send'.

- Wait a moment until the screen displays the requested information.

East Java

If you register your vehicle in the East Java area, you can use the official East Java Samsat website at the following link. Then follow the following steps.

- Open the Samsat East Java website from your desktop or mobile

- Select the Samsat from which your vehicle originates

- Enter Police Number

- Fill in the security code according to the available captcha

- Double-check all the fields that have been filled in, and make sure there is no incorrect data entered.

- Click 'Check Vehicle Data'

SAMSAT Official Website in Several Other Regions

Not only DKI Jakarta and Java Island, Samsat sites are also now present in various regions. You can directly search for it via Google according to your domicile.

After entering the website, then you can follow the procedure below:

- Prepare NOPOL and NIK

- Fill in the data as requested

- Make sure no data is missed or filled incorrectly

- Verify by filling in the captcha provided

- Click 'Search' or 'Submit'

3.5. Online Tax Application

Motor vehicle tax (PKB) can also be checked using a digital Samsat application called SIGNAL. You can download this application on the AppStore and Play Store.

This application can also make it easier for you to pay motorbike tax from anywhere as long as there is an adequate internet connection. On the other hand, by checking through the application you can find out more information than how to see the motorbike tax at the STNK.

How to check it, first you have to register first. You can follow the following steps.

How to Register an Account in the SIGNAL Application

1. Download the SIGNAL application on Playstore or App Store.

2. Open the application and select List.

3. Fill in all the requirements requested. Starting from NIK, name according to ID, email address, cellphone number, password, and password reconfirmation.

4. Click Next.

5. Enter a photo of your KTP, and make sure the photo is clear with sufficient lighting.

6. Verify the face with biometrics. The trick is to point the camera at your face, then make sure your face is in the photo area provided.

7. If it is appropriate, click Use This Photo.

8. Next you will receive an OTP code.

9. Enter the OTP code in the application until it says Registration Successful.

10. Re-registration via previously registered email.

11. Registration has been successful, you can use the application according to your needs.

After that, immediately register the vehicle through the following steps.

How to Register a Vehicle in the SIGNAL Application

1. Open the SIGNAL application.

2. Select the Add Motorized Vehicle icon on the homepage.

3. Enter your motorized vehicle registration number.

4. Enter the last 5 digits of the chassis number.

5. Click Next.

6. Your vehicle has been successfully registered in the SIGNAL application.

How to Check Motor Taxes in the SIGNAL Application

1. log in to your account

2. Select the NRKB menu then click 'Continue'.

3. Information on your mobile phone will display information about the PKB and SWDKLLJ payment rates.

4. If you plan to pay taxes soon, you can select Continue for the next process.

This is a review regarding how to view motorbike taxes at STNK along with other alternative options. We hope that this article can help you pay your motorbike tax on time, so you can avoid fines that might cost you.

BFI Finance is a company that provides multi-purpose loans with guarantees for motorbike bpkb, car bpkb, and house or shophouse certificates