Financial resolution is a goal that a person or family wants to achieve within a certain period of time. This resolution is generally made to welcome the new year, in order to achieve short-term and long-term financial goals.

Starting from improving personal finances such as income and expenses, and managing debt, to long-term goals which include emergency funds, savings, investments, and financial freedom.

Well, to achieve this, of course, there are some things you have to do as a form of action in making it happen. Do you know what to do? If not, let's look at the following financial resolutions in 2023!

1. 3K Financial Resolution

Have you ever heard of a 3K financial resolution? Reporting from the OJK's official website named sikapiuangmu, there are 3 important aspects that you can apply to overcome financial problems, especially to achieve your financial goals.

These three aspects are abbreviated as 3K which consists of Desires, Needs, and Capabilities. By recognizing all three, you can make more organized financial resolutions.

1.1. Desire

Every individual must have desires, regardless of what desires they have. Having desires is natural and very normal. However, don't let this desire become a barrier to meeting your needs.

Before you comply with existing desires, be sure to give pause to think and recall whether all your needs have been met or not.

You can also make a list of wants and needs to make sure everything is in the right portions. So, it will be easier later to distinguish between wants and needs. If you are disciplined enough to apply this, it is not impossible that your finances can get better.

1.2. Necessity

Every individual has different needs. Basically, needs are something that must be met for survival. Remember, needs must come before wants.

As with the wish list, you can also make a list of monthly and daily needs to make it easier for you to adjust the required costs.

1.3. Ability

After you know what your list of needs and desires is, the next step is to adjust these two things to your abilities. Because increasing wants and needs will burden your expenses.

Some of us may choose to seek additional income or even be willing to go into debt in order to achieve both. This is not entirely wrong. However, it would be nice for you not to burden yourself or force your will. If your wish can't be realized this year, you can put it in a long-term goal to then become a financial resolution in the coming year.

2. Financial Resolution 2023

Financial resolutions must be clearly drawn up so that it makes it easier for you to monitor progress and make it happen. The beginning of the year is a good start for making financial planning. After you know the three important aspects of financial planning, then you can apply the following 7 2023 financial resolutions as one of the strategies.

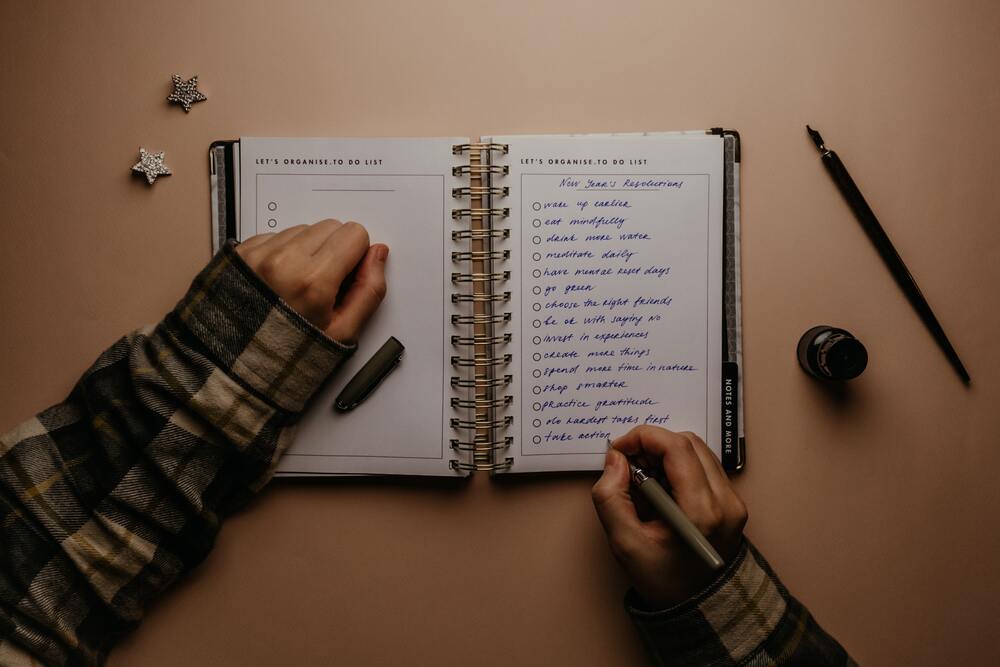

Image Source: Pexels/Karolina Grabowska

2.1. Recognize Where Needs and Wants

Often we are caught in a situation where we unknowingly spend money on something we don't really need or in other terms hungry for eyes. This phenomenon can occur when you are unable to separate needs from wants.

Needs are basic things that must be met by a person for the sake of survival, such as food, clothing, health, and shelter.

Meanwhile, desire is something that is desired by someone, but not always needed to meet basic needs. Desires are generally subjective and influenced by personality, interests, and habits.

Tips for Distinguishing Between Needs and Wants:

- Give it a moment to think and ask yourself if you need it or just want it.

- Grouping desires into certain categories. This is done to make it easier for you to make wise decisions. For example, desires related to hobbies, careers, family, finances, and so forth.

2.2. Create a Detailed Monthly Expenditure and Income Budget

The second step you can take as a financial resolution for 2023 is to make detailed budget funds. These details must include the income and expenditure budget. You are also required to make it as detailed or as detailed as possible.

Tips for Creating an Effective Fund Budget:

-

Setting Financial Goals

Before you make a budget, it is important to have a clear picture of the goals you will achieve, be it in the short, medium or long term. This is useful to assist you in determining priorities.

-

Calculating Total Income and Expenditures

Make a detailed list of your sources of income, starting from salary, bonuses, passive income, and so on. Also calculate all your expense lists, starting from monthly needs, installments, recreation funds, and others.

-

Create a Needs and Wants List

Group your expenses into needs and wants. With this list, you can easily decide which ones should be fulfilled immediately and which are not.

-

Setting Budget Limits

After you have successfully calculated the total income and expenses, then determine the budget limit for each existing category. That way, your finances will be more organized.

2.3. Save more

The third financial resolution is to save money. By saving you can allocate existing money for more important needs. Not only that, saving money can also help you avoid financial problems such as being in debt and not having enough money to meet basic needs.

In short, being frugal is an effective way to achieve your financial goals more easily. One of the easiest ways to save money is to cook at home. Besides being cheaper, cooking at home tends to be healthier and can improve your cooking skills.

2.4. Consistent To Save

Train yourself to save consistently is your next financial resolution. Surely you've heard the saying "little by little, gradually becomes a hill." This sentence is the right sentence to describe the results obtained by saving consistently.

Saving does not have to be with a large nominal, as long as you do it regularly, whatever the amount, it will definitely be a lot in the future. Come on, start good habits in 2023 by saving regularly.

2.5. Paying Off Debt

If you still have debt or installments that must be paid off in 2023, then paying off the debt will be a financial resolution that should not be missed. There are several ways to pay off the debt you can do. Among them are rearranging expenditure items, debt recapitulation, paying off the largest debt first, selling items that are no longer used but still viable, and looking for additional income.

2.6. Multiply Investment

If you've never invested before, this might be a good time to start. Investment is a financial resolution that can help you achieve your future financial goals and is able to generate higher profits than just keeping it in a bank account. Be sure to invest in legal financial products, and avoid Ponzi schemes and monkey business which have been rife everywhere lately.

Tips for Choosing Investment Products

- Set investment goals. Is it for retirement funds, increase income, or other purposes

- Learn about risk and return. All investment products have different risks, including the existing returns. Customize investment products with your financial condition and ability.

- Make sure you understand the selected product. Understand completely what you are going to buy.

- Portfolio servicing. Manage existing investment funds in several products to avoid the risk of total investment failure. Avoid putting all on one investment instrument.

- Update with the latest news. By following the latest news related to investment, you can better understand the financial product you choose, find out good investment performance, and determine future steps.

2.7. Prepare an Emergency Fund

An emergency fund is a fund prepared for emergencies. For example, in anticipation of a disaster, layoffs, falling ill, going bankrupt, and other things are quite a burden on expenses.

These funds must be prioritized so that the necessities of life can be fulfilled and able to survive when unexpected things occur.

This fund must be owned by everyone, both those who are still single and those who are already married. Keep in mind, these funds can only be used in urgent situations and outside of spending and savings items.

Amount of Emergency Funds that Must Be Prepared

- Single / Not Married = 3 - 6 times the spending per month

- Already married = 9 times the monthly expenses

- Married and Have Children = 12 times the monthly expenses

2.8. Opening Your Own Business

In addition to the seven financial resolutions above, you can also implement other solutions, namely by opening your own business. There are many types of businesses that you can try according to your interests and the amount of capital you have.

You can try to open a small capital business starting from a business idea with a capital of 1 million to a business with a capital of 10 million. Apart from that, you can also take advantage of various online platforms to do business digitally.

If you need additional capital, you can submit it to BFI Finance. BFI Finance is the largest multipurpose company in Indonesia.

Borrowing funds at BFI is more profitable with a vehicle BPKB guarantee loan or a house certificate. You can find complete information regarding loans at the following link.

BFI Finance is a company that provides multi-purpose loans with guarantees for motorbike bpkb, car bpkb, and house or shophouse certificates

Get other useful information only on the BFI Blog. Latest articles every Monday - Friday!