Share Information

History of share issuance is as follows:

|

|

Corporate Action |

Period |

New Shares Issues (million) |

Outsanding Shares (million) |

|

|

IPO @5.750 |

April 1990 |

2.1 |

10.5 |

|

|

1-for-10 Stock Dividend |

January 1993 |

1.2 |

11.7 |

|

|

17-for-20 Stock Bonus |

July 1993 |

9.9 |

21.6 |

|

|

1-for-3 Stock Dividend |

January 1994 |

7.2 |

28.8 |

|

|

1-for-1 Rights Issue @Rp1,500 |

May 1994 |

28.9 |

57.7 |

|

|

2-for-1 Rights Issue @Rp1,000 |

March 1997 |

115.4 |

173.1 |

|

|

2-for-1 Stock Split |

September 1997 |

173.1 |

346.2 |

|

|

New Shares from MCB Conversion |

August 2002 - May 2006 |

414.2 |

760.4 |

|

|

2-for-1 Stock Split |

Agustus 2012 |

760.3 |

1,520.7 |

|

|

MESOP Phase I - Grant Date 1 |

May 2013 |

5.9 |

1,526.6 |

|

|

MESOP Phase I - Grant Date 2 |

May 2014 |

23.3 |

1,549.9 |

|

|

MESOP Phase II - Grant Date 1 |

May 2015 |

16.0 |

1,566.0 |

|

|

MESOP Phase II - Grant Date 2 |

May 2016 |

30.8 |

1,596.7 |

|

|

10-for-1 Stock Split |

June 2017 |

14,370.4 |

15,967.1 |

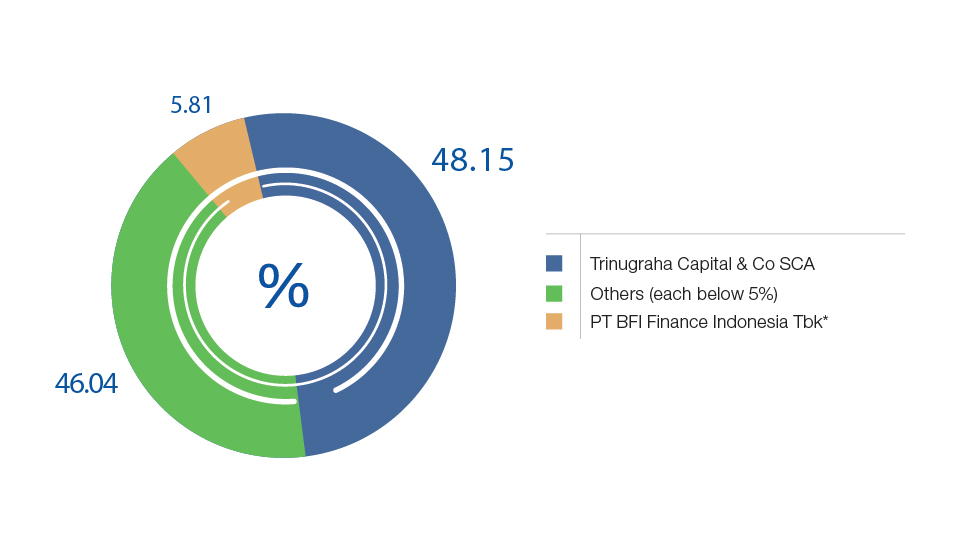

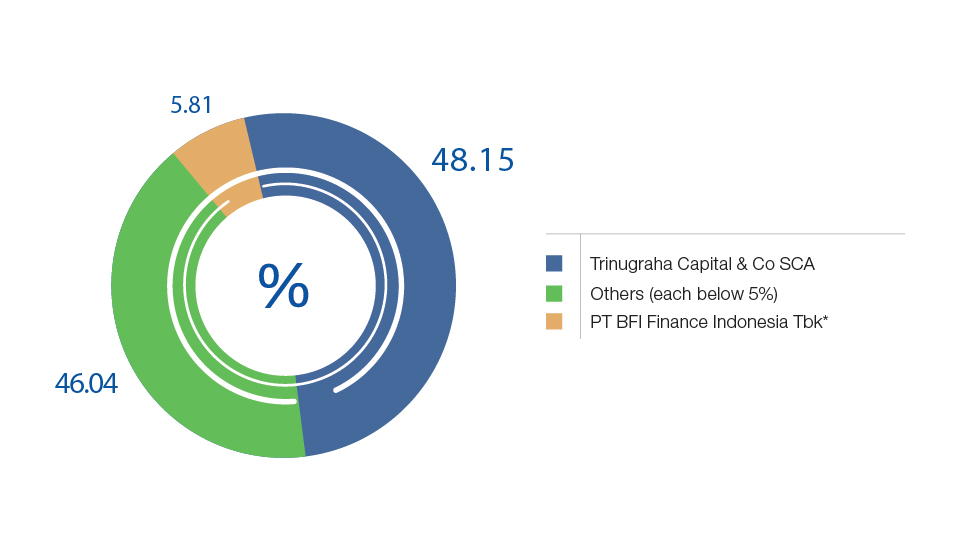

BFI Finance's structure of shareholders with ownership of 5% or more are detailed below:

|

Shareholders |

Data as of 31 December 2022 |

||

|

Total Shares |

Nominal Amount (Rp) |

% |

|

|

Trinugraha Capital & Co SCA |

7,688,125,938 |

192,203,148,450 |

48.15 |

|

PT BFI Finance Indonesia Tbk* |

927,732,000 |

23,193,300,000 |

5.81 |

|

Others (each below 5%) |

7,351,257,682 |

183,781,442,050 |

46.04 |

|

Total of Issued and Fully Paid-up Capital |

15,967,115,620 |

399,177,890,500 |

100.00 |

* Result of the Company's stock buyback program in line with the EGMS resolution on 15 April 2015 and the remaining treasury stock after the MESOP implementation based on the EGMS resolution on 29 June 2022

Shareholder Composition

Regarding BFI Finance’s share ownership, there are two institutions that each holds more than 5% of shares, namely Trinugraha Capital & Co SCA (48.15%) and PT BFI Finance Indonesia Tbk (5.81%).

Shareholder Composition

Regarding BFI Finance’s share ownership, there are two institutions that each holds more than 5% of shares, namely Trinugraha Capital & Co SCA (48.15%) and PT BFI Finance Indonesia Tbk (5.81%).